Your company or association must file a tax return (CT600) if you get a notice to deliver a Company Tax Return from HM Revenue and Customs (HMRC).

When we prepare and file a CT600 Company Tax Return, this is our standard service:

We communicate with you regularly to discuss any tax planning opportunities. This may be a discussion on whether the company will be investing in equipment, or vehicles so that we can ascertain the best time to invest for maximum tax efficiency and the balance of cashflows.

We prepare and review the financial statements (accounts) for any adjustments and differences between the accounting rules and the tax rules. There are many instances where the accounts can differ. One example is expenses or deductions that are not allowable for tax purposes – these must be adjusted for. Another example, is the tax claim for allowable deductions such as capital allowances. This is our standard, and we regard the preparation of the Company Tax Return as an independent task, separate from the accounting responsibilities.

We prepare the Company Tax Return in line with the financial statements (accounts). Our use of innovative software ensures that we have a handle on the relevant accounts being filed to Companies House and HMRC.

If the company has made a loss in the period, we consider the most tax efficient method of treating the losses across other accounting periods and the future.

We consider the remuneration of the company directors and share-holders. This will involve a review of salary levels, dividends and any loans between the company and its owners. This review is detailed and takes into account a number of factors:

– the profit of the company for the accounting period

– any available reserves from earlier accounting periods

– the capital contributed to the company by directors and share-holders

– the drawings made by directors and share-holders

– outstanding loan balances, between the company and its owners

– other personal income of the director or shareholder such as pensions or rental income

– tax efficiency between remuneration of salary and dividends

– the cashflow of the company and the owners

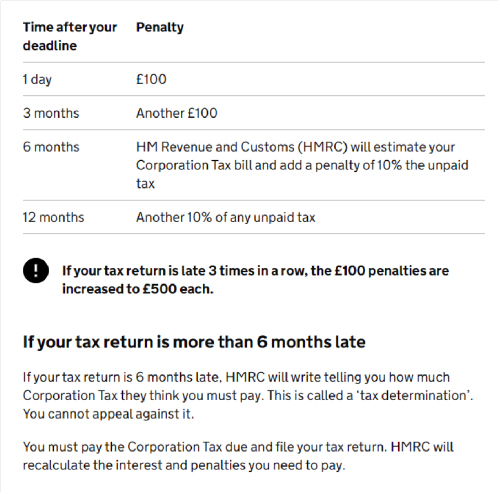

We complete the CT600 Company Tax Return as soon as possible after the end of the accounting period, even though the deadline for filing this return with HMRC is not until 12 months after the end of the accounting period. This is to ensure that you know of the corporation tax liability as soon as possible, so that it can be factored into the cashflow of the company.

In addition, the due date for payment of the corporation tax liability is 9 months and one day after the accounting period (unless instalments are necessary). This is an earlier deadline to the filing date for the Company Tax Return and so it makes sense to prepare for the reporting sooner rather than later.

We regard the preparation of the Company Tax Return as an independent task, separate from the accounting responsibilities. This gives us the opportunity to review the company’s tax position, the connection with the directors and shareholders, and tax planning opportunities.